To a greater or lesser extent, companies around the world have been affected and the real medium- and long-term consequences on a global scale have yet to be determined.

The company I work for is mainly dedicated to offering cost management solutions for mobile workers. We manage the expenses of over 4,5 million workers in nearly 120 countries and this gives us a unique perspective on how confinement has affected the travel industry, and in particular means of transport (by land, sea or air). to restaurants and hotels.

Business activity and mobility have fallen to unprecedented levels in modern history. Nothing we do not know, but when you analyze the numbers of March or April and compare them with those of the previous month, you realize the extent of the tragedy suffered in just 6 weeks of imprisonment. Airlines, trains, taxis and hotels have reduced bookings and sales by between 65% and 95% in Europe alone.

But all the indicators and data we are seeing now tell us little about the medium- and long-term effects. The coronavirus pandemic has changed our world and only time will tell if it is here to stay or if it will only be temporary.

It is still too early to know whether the teleworking that many workers have been forced into will be a specific situation. But it is clear that those companies that weren't prepared had many more problems and problems than they were.

The use of collaboration and communication solutions such as Slack and Zoom has increased significantly.

Companies that did not use these tools before the pandemic, but adopted them to be able to work from home, will likely continue to use them extensively once their employees return to the office.

One of the functions of the company that is usually less prepared for a telecommuting policy is the financial operation, which is often still much more dependent on paper-based processes and on-premise software than other functions.

With confinement it is evident that many travel expenses have disappeared or have been significantly reduced, but, paradoxically, many employees who previously did not travel need to allocate other expenses to their company (telephony, online training, hardware, software, stationery, courier ) for there remains the need to manage employee expenses.

In many companies, employee bills and expenses are often still submitted on paper to the finance department, where they must be manually reviewed and approved, often by multiple employees, and then manually entered into the accounting system.

In international companies, some of these documents require translation. If translation services are needed, they can search for them on IsAccurate, while others prefer to incorporate the service within their own company.

Not only does it require the process to be physically centralized, it is also incredibly inefficient and requires time and resources that could be better spent elsewhere, whether in the office for more productive tasks or allowing employees to enjoy their time off automation. contribute.

In the event that employees have to work from home, this process stops completely.

External mail piles up (assuming couriers keep delivering) and mail at the office stops.

Without someone to review and approve employee bills and expenses or manually enter data into the financial system, suppliers are not paid and employees are not reimbursed.

This may not be a big deal when an office closure lasts for a week or two, but if the closure is extended, it could start to have a significant impact on personal and business cash flow.

Many businesses and freelancers are concerned about the financial impact of the coronavirus from the potential loss of customers and revenue, so anything that can be done to minimize this impact will go a long way.

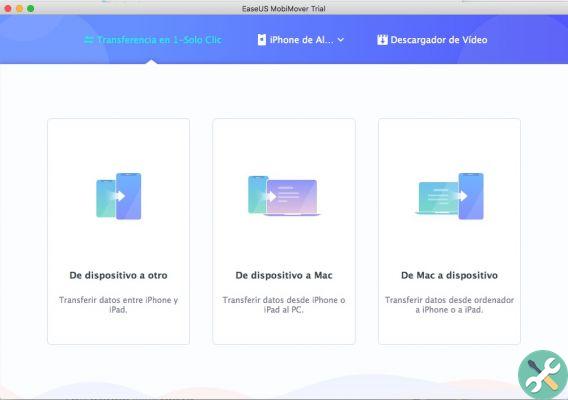

Digitizing employee expense management and supplier invoice management and abandoning manual and paper-based processes can not only make the process much more efficient for employees, who no longer have to worry about saving receipts and completing paperwork. calculation, but also make the verification, approval and reconciliation process much more efficient for the finance team.

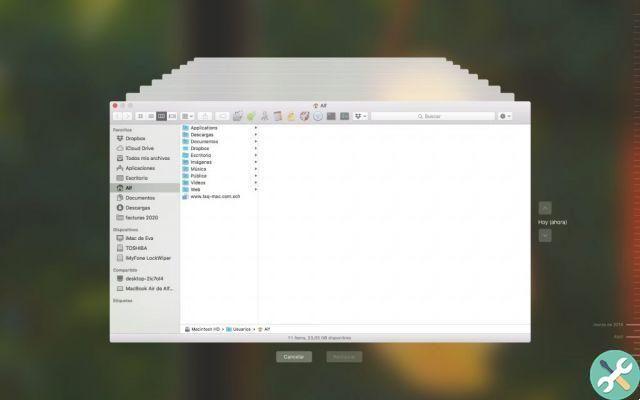

Employees simply have to capture and upload a picture of the receipt or forward an expense email to the system, which will automatically scan and analyze the transaction data to create an expense report.

Expense policy rules are already configured in the system, so employees (or their approvers) do not need to check whether each expense falls within the company-determined policy.

Once submitted, approvers receive an email notification that they need to approve an expense report.

There they can easily view images of receipts and transaction details and see whether or not an expense is within company policy with an on-screen notification. Once the spend is accepted, the next person in the approval chain receives the notification, and so on.

After final approval, the data can be automatically exported and timely encoded for reimbursement to the employee.

The vendor invoice approval workflow situation can similarly be simplified to enable distributed finance teams by implementing a vendor invoice solution.

An added benefit of automating these previously manual processes is the human impact on employees.

Employees on the go no longer have to spend hours at the end of their commute filling out expense reports, so they can spend more time on productive work or with family.

Approvers do not have to keep checking what is and what is not within the policy.

And for the finance team, instead of having to manually verify and enter data row-by-row into the accounting system and set up verification runs, they can focus their time on tasks like planning and data analysis.

The confinement and consequent teleworking will force to accelerate the adoption of digitization in financial departments.

And this is here to stay.

![Google also wants your Apple News [Updated] [2]](/images/posts/943dc0d8f28fcc4bc16fa30ed6d71f6a-0.jpg)

![Apple Vice Presidents Talk About Development of M1 for Mac [Updated]](/images/posts/c6254b668e5b3884d6b6338ccb8a02ff-0.jpg)