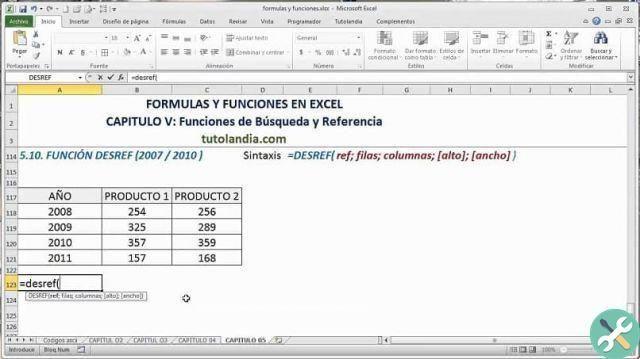

One of the main challenges facing both customers and the company is keeping the accounts and therefore being able to choose the tax regime correct. Many people usually have various complications with this problem, so here we will help you clarify a few things.

How to keep Uber accounts

In general, the Uber platform partners, when they registered on the platform, are mostly natural persons, many have a job, some business that gives them a extra income of money or in some cases they are in the informal sector.

Those who have an established tax regime generally have some kind of formal activity and therefore do not need to carry out their registration procedures, but on the contrary they only have to indicate Uber in their accounting as a new economic activity, which is in addition to the rest of its obligations.

Expenses that can be included in the accounting for Uber

Although there is no formal list in which most of the expenses that can be included in an accounting for are broken down Uber, it is important to know a rule that applies to all cases:

The expenses must be strictly necessary to obtain an income. In the specific case of an Uber, it is all those expenses that must be incurred to provide a optimal service to the users of the application. This is often discussed in Uber offices, but there's a chance you won't be told much in depth.

Here are some examples

- Il vehicle itself is deductible .

- Oils and lubricants are also on this list.

- Disposable accessories for optimal vehicle operation.

- Car cleaning products.

These are some examples by which you can better locate me when creating your list, but you should keep in mind that this can also vary, depending on the car model and country of residence. It is important that you always ask yourself:

Is it a necessary expense to give good service? If the answer is yes, you can enter it in your accounting Uber, otherwise it is deductible.

How to keep your tax status in order

An important task of all workers is to maintain the constantly updated accounting. You can look for a quick fix and hire a person or company to take care of this. Because it is one thing to be aware of the destination the user wants to go to, and it is quite another to keep accounting. This is because it already has a pre-established list of your needs as an Uber application partner and driver by default.

You can opt for a comprehensive accounting service, where you can view all your information clearly and concisely. So when it comes to making your invoices, it will be much easier and your tax return will always be up to date.

You can also find various consulting services that you can rely on expert accountants, which will give you personalized attention.

Essential tax services for Uber drivers

- They must have a determination of their taxes.

- Special billing program for each driver

- Bimonthly presentation of RRP and VAT

With this information, you will be able to carry out your tax procedures and services without any setbacks and keeping all your accounts updated without errors within Uber. So you can also maintain excellent control of the resources you may have within the application.

TagsUber